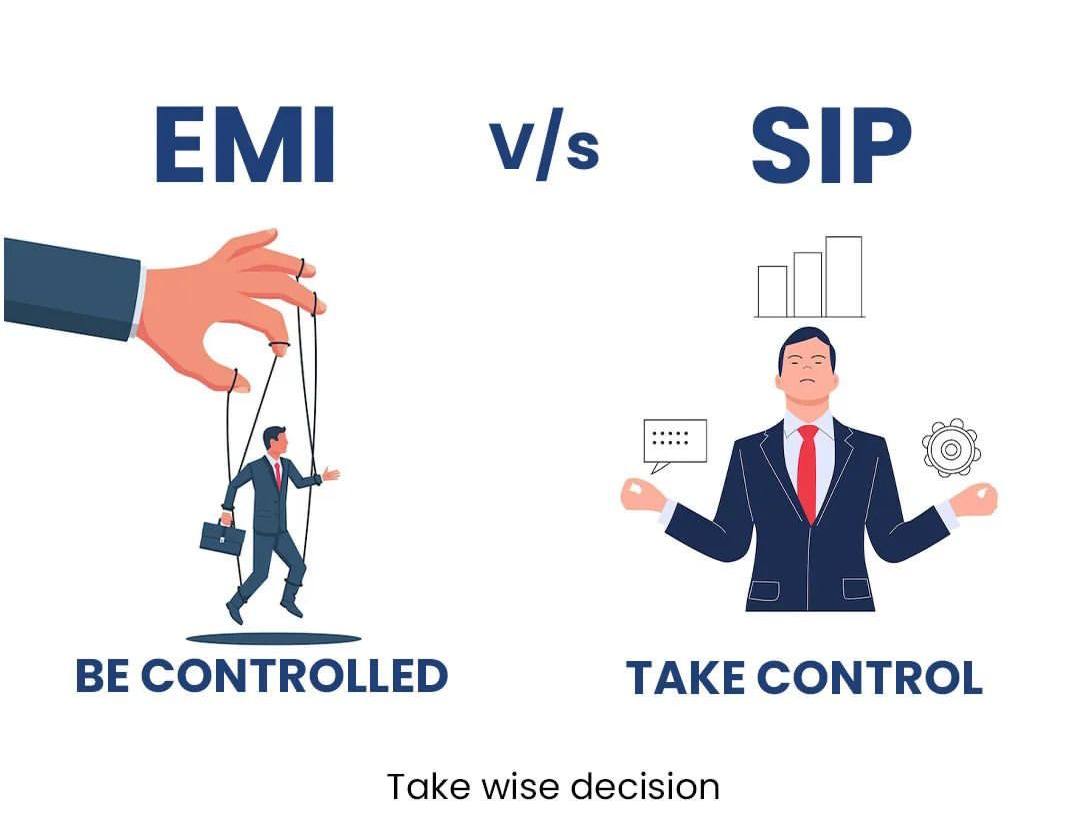

If you’re wondering how you can grow your money over time, starting a Systematic Investment Plan (SIP) in a good mutual fund is one of the best ways to go about it. Whether you are just starting off on your investment journey or looking to diversify your portfolio, July 2025 presents a wonderful opportunity. In this blog, let’s discuss the best funds to consider and the reasons why SIPs remain one of the most preferred and effective investment strategies in India.

💼 Why SIPs Still Make Sense In 2025

As mentioned above, SIPs let you invest with less stress. You choose a mutual fund, set your monthly investment amount, and detatch. With time, this can bring considerable rewards. Here are some reasonswhy SIPs continue to be a go-to option this year:

Market Volatility: With elections, rate cuts, and global tension, SIPs equalize the highs and lows of the investment.

Ease Of Use: Starting to invest is as easy as ₹500 a month.

Compounding Works: Small, consistent contributions can grow tremendously.

Flexible Automation: You can stop, increase or change pace. Everything is in your hands.

🔍 How to Choose the Right SIP Fund

Before you pick a mutual fund, be sure to check the following:

Past Performance: Look at the fund’s performance for the past 3, 5, or even 7 years.

Fund Manager: Someone with an established track record has better odds of making good fund management decisions.

Expense Ratio: Returns surpass expenses. Lower expenses perk up returns.

AUM (Assets Under Management): A healthy AUM shows investor trust.

Your Goal: Do the fund’s offers align with your financial milestones, comfort with risk, and investment horizon.

📈 7 Mutual Funds to Consider for SIP in July 2025

Here are some selected SIP mutual funds that stand out for solid growth, strong fundamentals, and good risk-adjusted returns:

1. Quant Flexi Cap Fund

Category: Flexi Cap

Why It’s Great: Best performer of 2025 so far, thanks to smart sector rotation.

Returns: ~24% (3-Year CAGR)

Best For: Aggressive investors with long-term goals.

2. SBI Small Cap Fund

Category: Small Cap

Why It’s Great: Finds hidden gems in the smallcap space, backed by strong research.

Returns: ~21% (5-Year CAGR)

Best For: High-risk takers with a 5+ year view.

3. HDFC Balanced Advantage Fund

Category: Hybrid

Why It’s Great: Moves funds between equity and debt based on market signals—very beginner friendly.

Returns: Approximately 13% (3-Year CAGR)

Ideal For: Conservative or first-time investors.

4. Mirae Asset Large Cap Fund

Category: Large Cap

Reason for Appreciation: Excellent large cap stock selection and steady performance.

Returns: Approximately 15% (5-Year CAGR)

Ideal For: Investors seeking long-term growth with lower volatility.

5. Kotak Emerging Equity Fund

Category: Mid Cap

Reason for Appreciation: Good coverage of growing mid-cap companies.

Returns: Approximately 18% (3-Year CAGR)

Ideal For: Those willing to take moderate risks compared to large cap stocks.

6. Parag Parikh Flexi Cap Fund

Category: Flexi Cap

Reason for Appreciation: Better diversification by mixing Indian and foreign stocks.

Returns: Approximately 19% (5-Year CAGR)

Ideal For: Investors wanting to have overseas exposure with domestic investments.

7. Axis Bluechip Fund

Category: Large Cap / Bluechip

Reason for Appreciation: Low risk investment in strong brand-name companies.

Returns: Approximately 12% (3-Year CAGR)

Ideal For: Cautious long-term investors.

✨ Pro Tips for SIP Success

Start Early: Absolutely delay no further. Compounding is time-dependent, so the more time, the better.

SIP To Stay Invested: Do not “stop” during market downward tick periods. These moments can be some of the best for entering.

Review Annually: Look through the results of your funds every year.

Additional Pro Tip: Mix large caps, mid caps, and hybrid funds.

Additional Pro Tip: Get lower fees and better returns by choosing direct plans.

📚 Final Thoughts

Starting or scaling your SIP investments looks best around July 2025. Markets might seem volatile, but persisting with your SIP strategy will support your qualifications over the long haul.

There’s room for everyone to improve, whether you’re a newcomer to mutual funds or you already have a few SIPs running. Align your investments with your goals and risk appetite using the list above as a starting point.

As usual, reach out to a registered SEBI financial advisor if any doubts arise. Happy investing!

Disclaimer: This is meant as a blog post for educating. Always consult a fiduciary before acting on one’s investment strategy.