Are you just starting on your investment journey and dont know where to put your money? In India, mutual funds rank among the safest and most trusted ways to grow wealth over many years. Whether you are saving for retirement, a first home, or simply want higher returns than a bank account, these funds spread your money across stocks and bonds while trained managers watch it daily.

In this post we will explain what mutual funds really are, how they do their job, the main types you can pick, and practical steps to choose the right one in India for 2025.

💡 What Is a Mutual Fund?

A mutual fund gathers cash from lots of investors and hands that pool to a professional manager. That expert then buys shares, bonds, or short-term money-market tools on your behalf.

You never have to check prices every hour; the fund team does, turning this option into a hands-off choice almost anyone can handle.

Table of Contents

🔍 Types of Mutual Funds in India

1. Equity Mutual Funds

– Most of the money goes into company shares.

– Built for people who want big growth over ten years or more.

– Suited for those ready to face stock-market swings.

2. Debt Mutual Funds

– Focus on government bonds and other fixed-income securities.

* Low-risk option, best for short to medium stays.

3. hybrid funds

* mixes stocks and bonds.

* try to balance risk and reward.

4. elss (equity-linked saving scheme)

* tax-saving funds found under section 80c.

* locked in for 3 years.

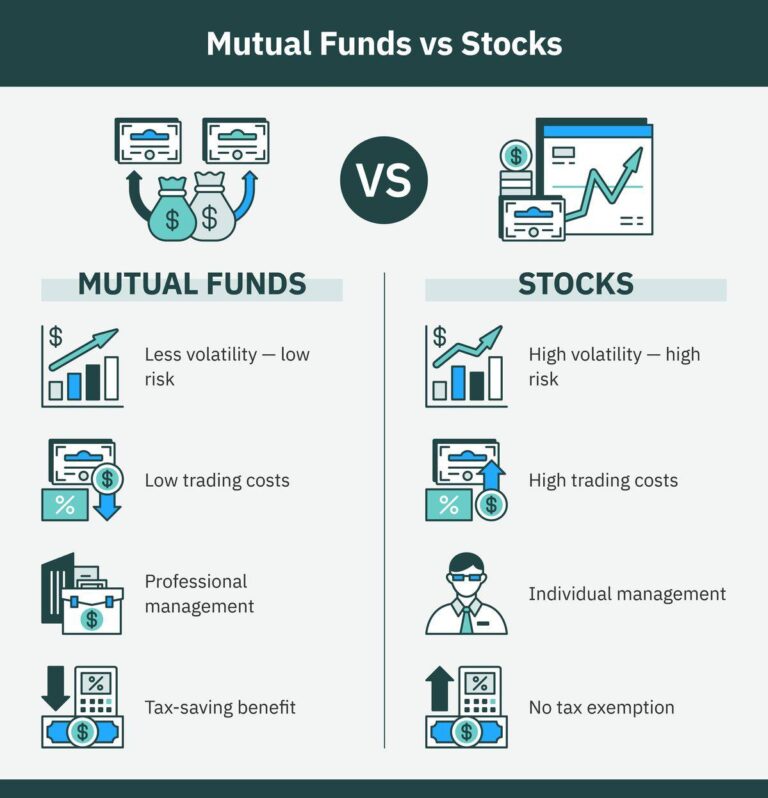

why invest in mutual funds?

* ✅ diversification spreads risk across many assets.

* ✅ professional management run by sebi-registered pros.

* ✅ low minimum start with as little as ₹500.

* ✅ liquidity most funds are easy to enter or exit.

* ✅ sip option put in a fixed amount every month.

how to start investing in mutual funds in india

1. set your goal (retirement, school, home, etc.).

2. pick a fund type (equity for growth, debt for safety).

3. choose a platform (groww, zerodha coin, paytm money, or go straight to the amc).

4. finish kyc (do it online or in the app).

5. start a sip or drop in a lump sum.

common mistakes to avoid

* ❌ never invest just because a fund did well last year.

* ❌ dont chase the hottest fund without digging first.

* ❌ dont skip asset allocation keep your portfolio balanced.

NAV, or Net Asset Value, shows the price of one share in a mutual fund. It tells you what a single unit is worth right now.

📌 Key Points About NAV:

NAV changes every trading day when the value of stocks and bonds in the fund goes up or down.

The number lets you check how much your investment is worth at this moment.

A low NAV doesnt automatically mean a better deal; focus on long-term returns instead.

When you buy today, the price you pay uses that days closing NAV.

◦ The coolest part of mutual funds for fresh yet savvy investors is that they build wealth steadily and spread it around-smartly-without forcing you to become a Wall Street expert overnight.

Check out these quick reasons they stand out:

🌟 1. Compounding Superpower (SIP Secret)

When you set up a Systematic Investment Plan (SIP), even tiny monthly sums keep earning returns on returns, and over years they can balloon into serious When you set up a Systematic Investment Plan (SIP), even tiny monthly sums keep earning returns on returns, and over years they can balloon into serious money.

📌 Example: Pour in just 5,000 every month for 20 years at a 12% return, and you wind up with more than 50 lakh rupees!

🔄 2. Start with Pocket Change

Want to kick off with only 100 or 500 rupees? Go ahead. You dont need a fortune to step into the markets.

🧠 3. Pro Managers Handle the Heavy Lifting

team of skilled fund managers and analysts chooses the right stocks or bonds while you carry on with your day job.

📊 4. Built-In Diversification

One fund can spread your money across dozens of companies in different industries, so you lower risk without juggling assets yourself.

📉 5. Use Market Drops as a Hidden Buying Chance

When prices slide, every SIP instalment buys extra units at a cheaper price. You wind up owning more while the market is on sale-automatic, stress-free dip buying.

🧾 6. Lock in Tax Savings with ELSS Funds

ELSS schemes let you claim deductions under Section 80C and still aim for equity-like gains, so your savings do double duty.

⚖️ 7. Pick a Risk Level that Fits You

Whether you play it safe or swing for big rewards, theres a fund-debt, hybrid, equity, global, gold-that matches your comfort zone.

🔍 Final Thought:

Best of all, mutual funds bring share-market growth within easy reach, sparing you the grind of stock-picking, timing guesses, and constant screen-watching.

✅ Conclusion

Mutual funds can grow your money over time-even if you only put in a little each month.

With a clear plan, steady saving, and the right fund, you wont have to watch the market constantly.

Start small, stay invested, and let compound growth do the heavy lifting.

🔎 SEO Meta Title:

Best Mutual Funds to Invest in India 2025 | Beginner Guide to Mutual Funds

📄 Meta Description:

Thinking of mutual funds in India? Discover top picks for 2025, types of funds, and how regular SIPs can boost your savings.

Would you like me to add:

– Internal links like those you see on mystocktobuy.com ?

– A quick call-to-action asking readers to subscribe or book a service?

– Tips for a catchy graphic or Instagram carousel to grab attention?

Just drop a note, and Ill tweak the post for you!

1 thought on “Mutual Funds in India: A Newbie’s Guide to Smart Investing in 2025”